In 1991, ten-year-old Jerry Nemorin and his family escaped civil war in Haiti and resettled in Florida. Jerry’s first experience with the US financial system was when his mom tried to buy a car. Twenty-five years later, Jerry still remembers the sign above the auto lot: “BUY HERE, PAY HERE.” Jerry’s mom was an immigrant and didn’t have any credit, so she took out a loan directly from the shop. “I was only twelve,” remembers Jerry, “but looking through the loan documents, I saw that the interest on the loan would cost more than the car itself.” But Jerry’s mom didn’t have a choice.

Jerry’s mom is representative of over 150 million Americans who can’t access $500 in an emergency. And when Jerry was in college, he wanted to dedicate his career to helping people like her. He got a job on Wall Street and attended business school first to understand how banking worked, until he had enough experience to develop a solution of his own. His company, called LendStreet, finds individuals who are responsible, conscientious citizens who have, through bad luck, found themselves in deep debt at often predatory interest rates (medical, credit card, student loans), buys up and consolidates their loans, and refinances them at a fair interest rate.

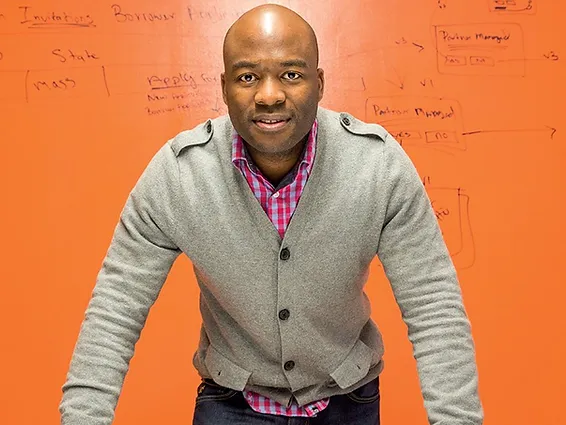

When I first met Jerry, I thought this was a great idea. But Jerry struggled to raise the money he needed to start his firm. I asked why he had a problem, and he said, “Investors are all about pattern recognition. As a black guy, in central Virginia, solving poor people’s problems, I was 0 for 3!”

Thousands like him

America is a nation of entrepreneurship and can-do innovation, and Jerry should have personified the American Dream. An immigrant’s kid who put himself through school and had an idea to help millions of people like his mom should have the chance to succeed. The business community overlooked Jerry’s idea.

And there are thousands of Jerrys. Despite the fact that Wall Street and Silicon Valley have never done better—the Dow Jones is at an all-time high, and there are more billion-dollar technology “unicorns” than ever before—entrepreneurial activity in America is actually at a 30-year low. More firms (and the dreams of the entrepreneurs that start them) are dying than starting every day. Meritocracy in America today is a myth.

Blind spots in our innovation economy are leaving the best ideas out of the conversation. We overlook entrepreneurs based on who they are—less than 10% of investment in new companies goes to women; less than 1% goes to people of color. We overlook people based on where they are—78% of startup investment goes to just three U.S. states (NY, MA, CA). And we often discount the ideas that have the highest impact—only 15% of over 200 billion-dollar “unicorns” are in the real-world industries that people interact with every day (food, health care, energy, education, agriculture, housing).

Blind Spots

Most investors aren’t doing this intentionally. Economists would say that resources flow to their best and most productive uses; Silicon Valley receives so much investment, an economist would say, because the most productive people and companies are there. But evidence would suggest differently-that people have an unconscious bias towards what they know and understand.

The first blind spot is in-group bias. As a black guy, Jerry struggled. People invest in other people like them. According to a study held by the National Bureau of Economic Research, identical resumes that read “Greg” got 50% more callbacks than ones that read “Lakisha. Only five per cent of investing partners at venture firms are women, and less than one per cent are people of color;” it’s no surprise that who gets an opportunity mirrors who decides who gets funding.

The second blind spot is availability bias. Living in Charlottesville, Jerry was far away from most capital sources. People invest in the ideas that are closest to them, or the last good idea they heard, versus the best. Almost 80% of investments are deployed in companies that are based within 30 miles of the investor. Funders are missing people like Jerry because they don’t look outside their own backyard.

The third blind spot is what I call “two-pocket thinking.” Most people think their investments need to focus on “what’s good for business”—making as much money as possible without any regard to the good or bad they’re doing in the world; and focus their volunteering, philanthropy, and nonprofit engagement on “what’s good for society,” without an eye towards financial sustainability. Jerry’s LendStreet merged two pockets: a profitable business, that also helps people get out of debt. Most investors didn’t think both were possible, but a growing body of evidence suggests that it is: Cambridge Associates last year, in studying hundreds of funds, found that investments that intentionally incorporated a social mission outperformed financially.

The good news: if we intentionally seek to include new ideas, we can overcome our blind spots. Jerry received an initial investment from angel investor Kapor Capital, who intentionally invests in African-American and Latino founders, looking where very few others are for new investments. He’s turned that $500,000 initial investment into a $40 million portfolio that’s refinancing the balance sheets of thousands of families across the country, and bringing them out of debt. Now, when Jerry talks to an investor, it doesn’t matter that he’s 0-for-3—he’s got the track record to get their attention. There are thousands of Jerrys, and if we want to make America the meritocracy we believe it can be, we need to overcome our blind spots to find them.

See the original article on BusinessInsider.com:

http://www.businessinsider.com/silicon-valley-venture-capital-missing-out-on-middle-of-america-2017-9